Reward Vaults

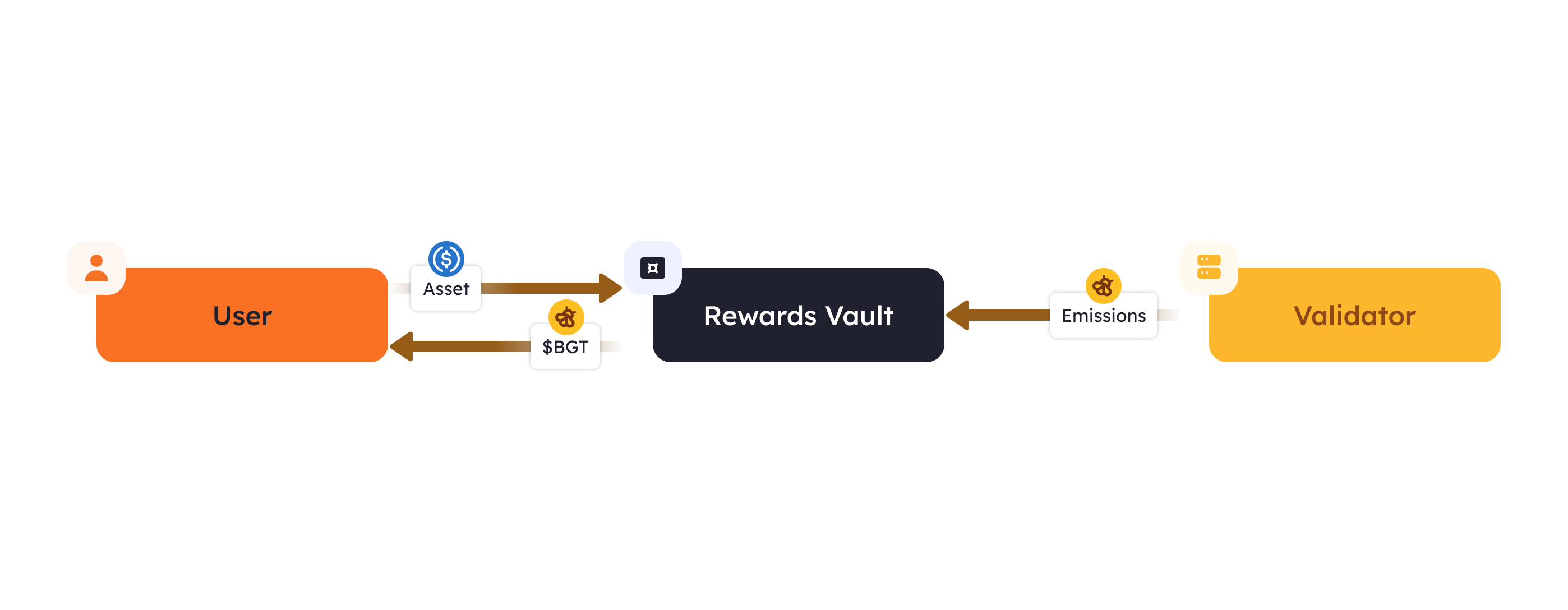

Reward Vaults are smart contracts where users can stake their Proof-of-Liquidity (PoL) eligible assets to receive $BGT rewards. Reward Vaults are the only way to earn $BGT rewards, which serve as the basic building blocks of the PoL ecosystem.

User Interactions

The amount of $BGT rewards a user earns from Reward Vaults depends on:

- The user's share of total assets staked in the vault

- The amount of

$BGTrewards emitted to the vault

After staking assets in a Reward Vault, users can claim earned rewards as soon as they are distributed, add to their existing deposits, or withdraw their assets at any time.

$BGT farming with Reward Vaults resembles familiar DeFi actions, providing a low barrier to entry for regular users.

How $BGT Ends up in Reward Vaults

Validators direct portions of their $BGT emissions to specific Reward Vaults.

To understand why validators choose to emit $BGT to particular Reward Vaults, refer to Incentives in PoL, which explains how protocols can influence validator behavior with economic incentives.

Creation of New Reward Vaults

New Reward Vaults are created through the Reward Vault Whitelisting process, conducted through $BGT governance proposals. Developers or protocols can submit proposals to create new Reward Vaults for specific eligible assets. If a proposal passes, the new Reward Vault is created and added to the list of approved Reward Vaults where validators can direct $BGT emissions.