Proof-of-Liquidity Participants 👥

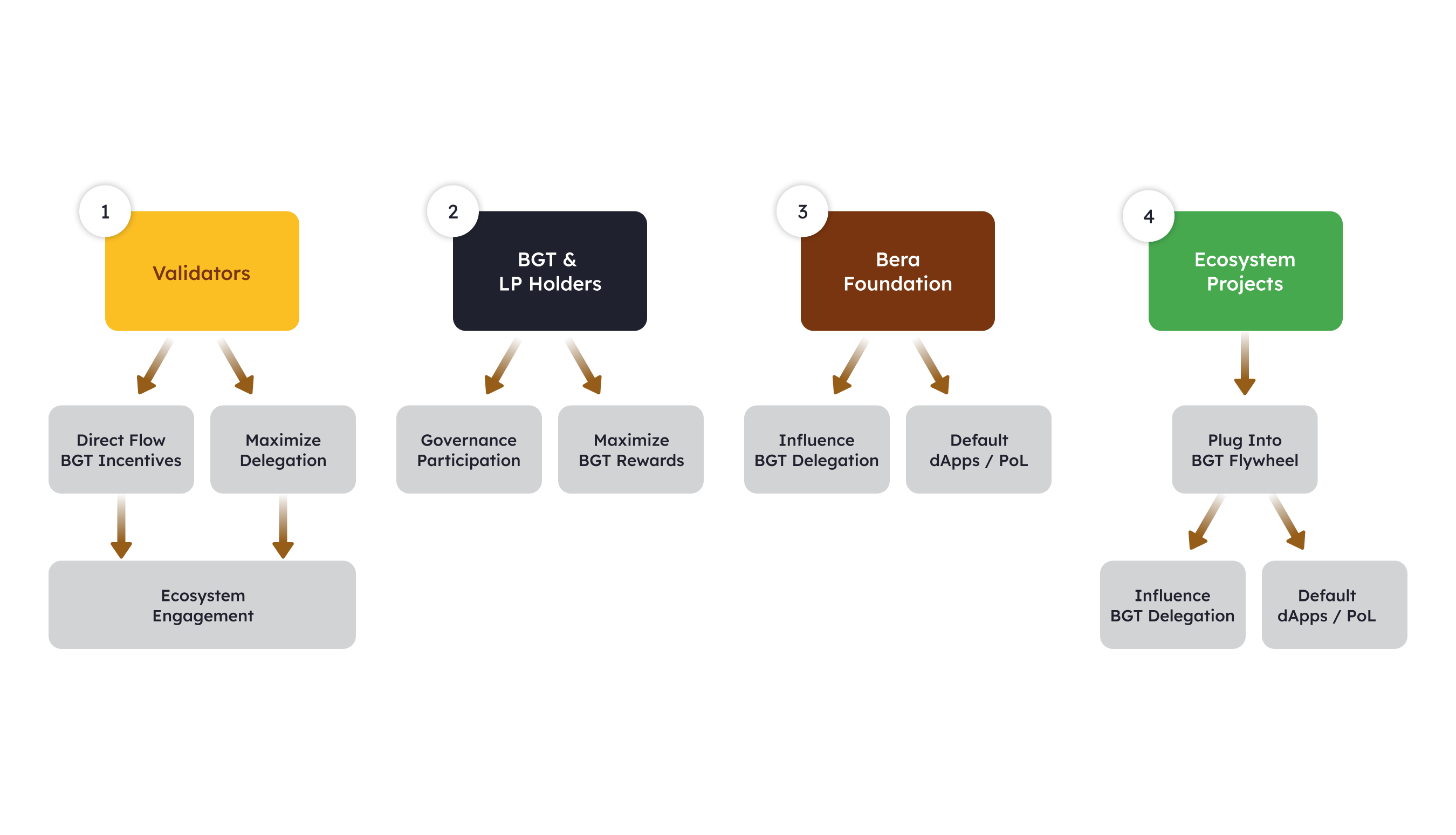

This article explores the different players in the Proof-of-Liquidity (PoL) ecosystem and their roles. The following diagram shows a breakdown of the different participants and their priorities/responsibilities:

Validators ✅

The active set of validators consists of the top 69 validators ordered by BERA staked. Being part of the active set entitles validators to earn block rewards, so a key priority for validators is to obtain sufficient $BERA stake to be in the active set. Validators earn through three primary means:

- Gas fees and priority fees

- Collecting incentives provided by protocols for directing BGT rewards to their Reward Vaults

- A base block reward (in

$BGT) for successfully proposing a block

Validator Incentives 💎

When a validator directs $BGT emissions to a reward vault, they receive project-supplied Incentives provided to attract these emissions (thus increasing the attractiveness of depositing into that project). These Incentives can be in the form of the protocol's native token or any other whitelisted ERC20 token.

Successful validators in PoL optimize for:

- Securing

$BGTdelegation to increase their block rewards - Efficiently exchanging

$BGTblock rewards for protocol incentives - Distributing value back to their

$BGTdelegators

BGT Holders & Farmers 🥕

BGT holders play a crucial role in:

- Voting on governance proposals

- Influencing economic incentives through

$BGTdelegation - Supplying ecosystem liquidity in reward vaults to earn

$BGT

TIP

$BGT that is delegated to validators is not subject to slashing. Only validators' $BERA stakes can be slashed.

Earning and Delegating $BGT ⬇️

Users can earn $BGT by staking PoL-eligible receipt tokens in reward vaults. These receipt tokens are generated by performing actions that benefit the Berachain ecosystem, such as providing liquidity to a BEX pool.

When selecting a validator to delegate $BGT to, users typically consider:

- Which reward vaults validators direct emissions to

- Validator commission rates and incentive distribution strategies

- Validator uptime and performance

The primary goal is to earn as many Incentives as possible through delegation.

BERA Stakers 🐻

The BERA Yield Module empowers $BERA holders to participate directly in the Proof-of-Liquidity ecosystem. BERA stakers help:

- Provide direct utility and demand for the network's native asset

- Earn yield from redirected PoL incentives

- Strengthen the economic foundation of the Berachain network

BERA Staking Mechanics 🔄

BERA stakers use the Staking Vault, an ERC4626-compliant vault that:

- Takes both native

$BERAand wrapped$WBERAdeposits - Earns yield from 33% incentive redirection of PoL protocol incentives

- Has a 7-day unbonding period for withdrawals

- Automatically compounds rewards for better yields

Earning Yield Through PoL 📈

BERA stakers earn yield through the incentive redirection mechanism:

- Protocols pay incentives to validators for directing BGT emissions

- 33% redirected during incentive distribution and sent to the Incentive Collector

- Incentives auctioned for WBERA

- WBERA distributed to Staking Vault stakers

The yield rate depends on:

- Total PoL incentive volume across all protocols

- Number of BERA stakers in the vault

- Market conditions and protocol activity

Strategic Considerations for BERA Stakers 🎯

Successful BERA stakers consider:

- Long-term alignment: The 7-day unbonding period encourages long-term staking

- Yield optimization: Monitor vault performance and incentive volume

- Risk management: Understand the smart contract risks and emergency controls

- Diversification: Balance BERA staking with other yield opportunities

TIP

BERA staking is completely separate from traditional validator staking. You can participate in both systems simultaneously.

Ecosystem Projects 🧸

Projects participate in PoL by:

- Creating a reward vault through the factory contract

- Submitting a governance proposal to whitelist the vault

- Supplying incentive tokens and managing rates in their vault

The Incentives marketplace allows protocols to bid for validators' emissions using whitelisted tokens, creating alignment between all stakeholders to increase the overall value of the network. Projects must also gain the favor of $BGT holders to enter into the PoL system.