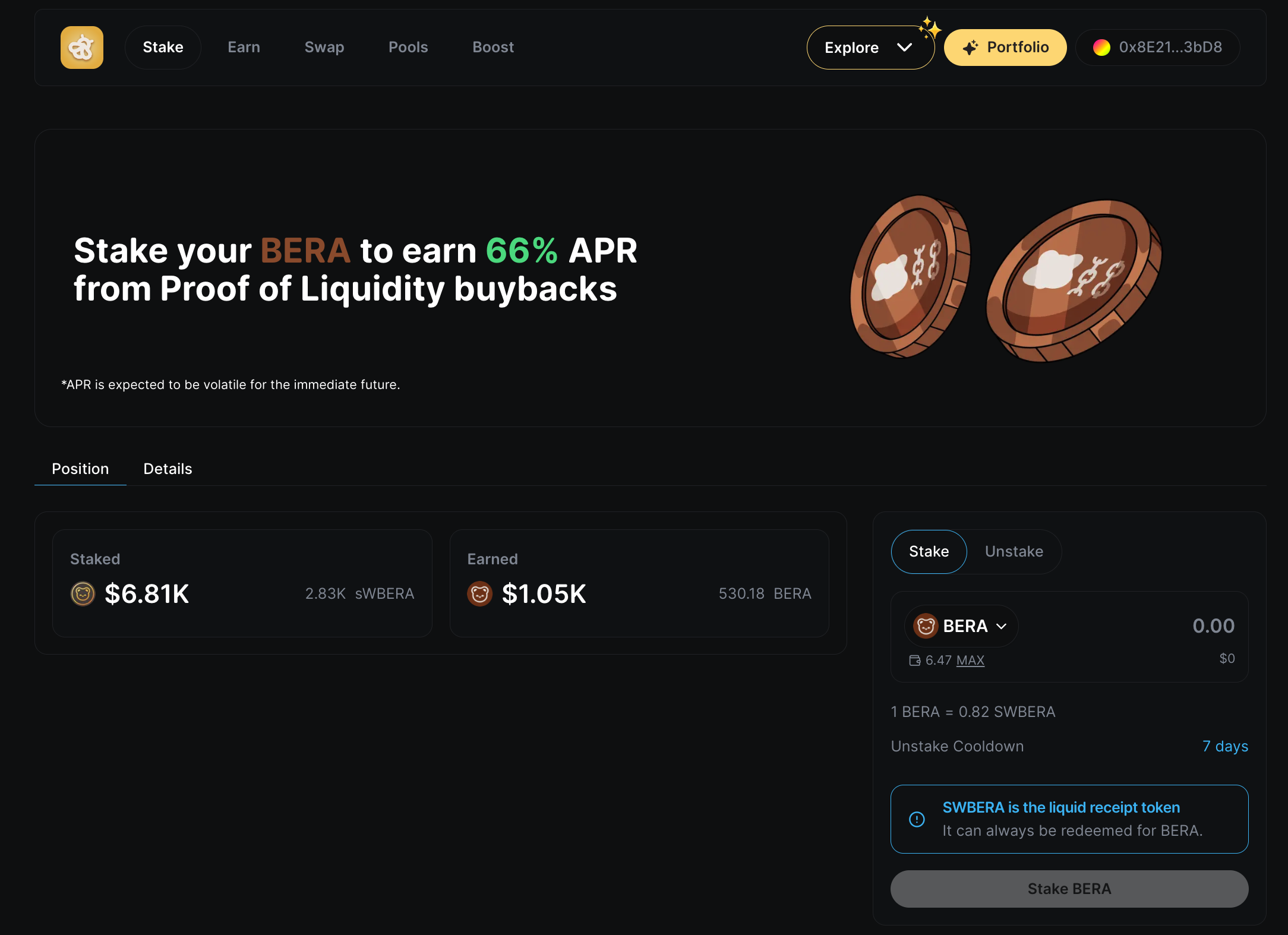

BERA Staking Guide 🐻

The PoL BERA Yield Module lets you stake $BERA directly and earn yield from Proof-of-Liquidity incentives. It's a simple way to earn yield on your BERA without diving into complex DeFi protocols.

Overview

The BERA Yield Module uses the Staking Vault, an ERC4626-compliant vault that:

- Takes both native

$BERAand wrapped$WBERAdeposits - Earns yield from redirected PoL incentives (33% of protocol incentives)

- Has a 7-day unbonding period for withdrawals

- Automatically compounds your rewards for better yields

How to Stake BERA

Option 1: Native BERA Staking (Recommended)

Connect your wallet to the Berachain network

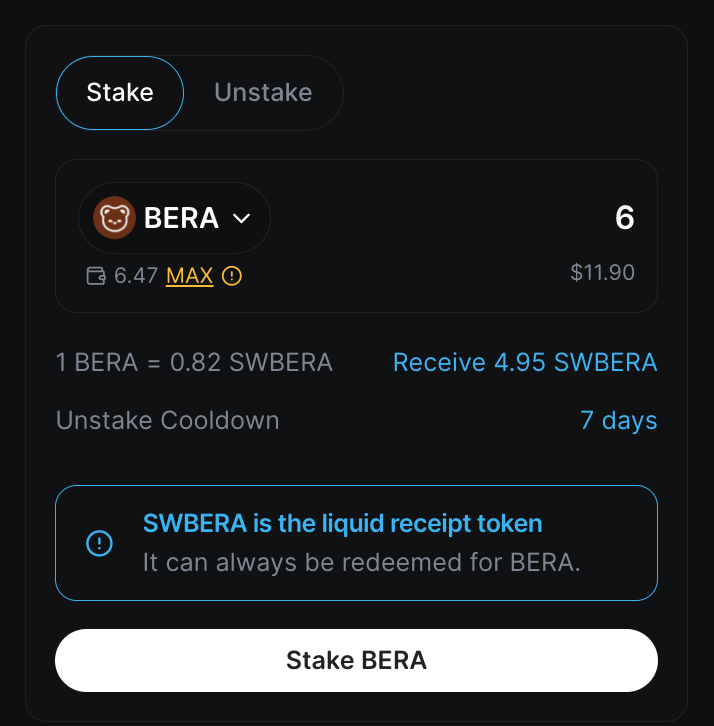

Select "Stake" and enter the amount of BERA you want to stake, then click Stake BERA.

Confirm the transaction - your BERA will be automatically wrapped to WBERA and deposited

Receive sWBERA tokens representing your staked position

Option 2: WBERA Staking

- Navigate to the Staking Vault interface

- Select "Stake" and click on the $BERA pulldown to reveal $WBERA as an option. Enter the amount of BERA you want to stake, then click Stake BERA.

- Confirm the Approve WBERA for the Staking Vault transaction.

- Confirm the Deposit WBERA transaction.

- Receive sWBERA tokens representing your staked position

Understanding Your Position

sWBERA Tokens

When you stake BERA, you receive sWBERA (Staked WBERA) tokens:

- Name: "POL Staked WBERA"

- Symbol: "sWBERA"

- Decimals: 18

- Value: Each sWBERA represents your share of the vault's total assets

Yield Calculation

Your yield depends on:

- Your share of the total vault assets

- The amount of WBERA distributed to the vault from incentive redirection

- Auto-compounding of rewards over time

The more sWBERA you have compared to the total supply, the bigger your share of the distributed rewards.

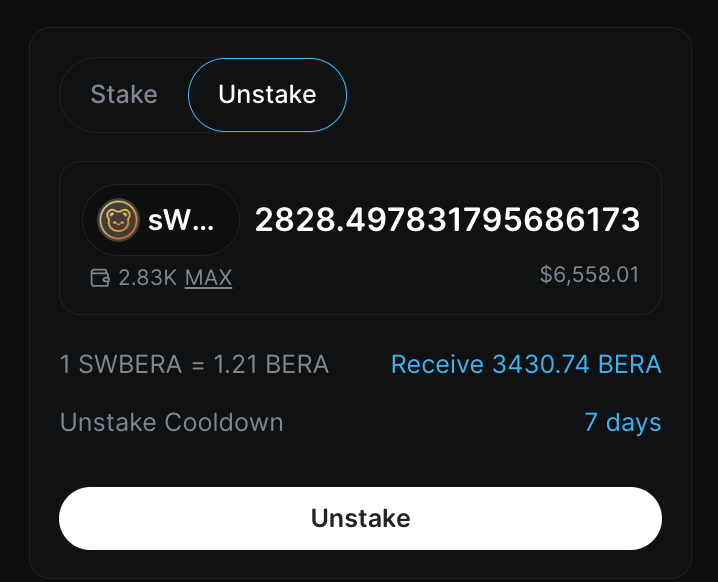

Withdrawal Process

7-Day Unbonding Period

To withdraw your staked BERA:

Click Unstake. Enter the amount you wish to remove, or click 'MAX' to exit your position. Click the Unstake button to confirm.

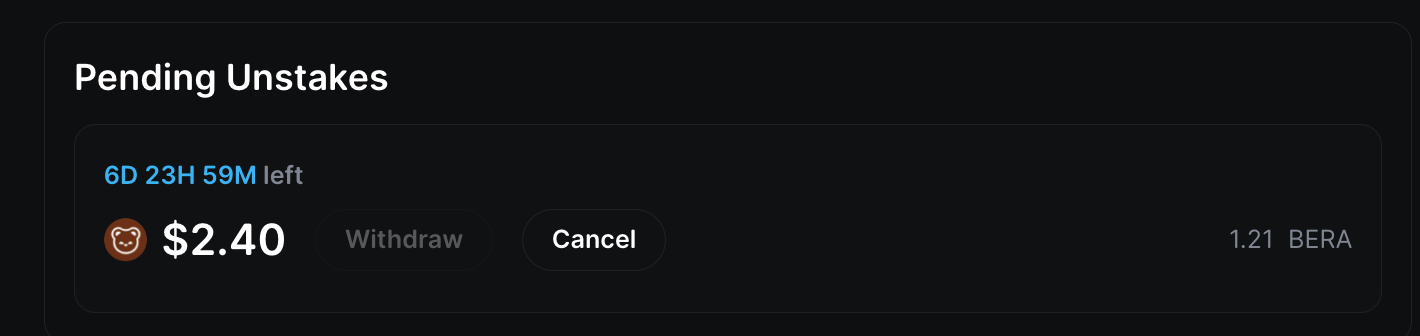

After you confirm the transaction, you will see your pending withdrawal in the interface with a countdown.

In 7 days, return to the staking interface, then complete the withdrawal by clicking Withdraw. After you complete the withdrawal, you will receive WBERA.

Withdrawal Options

The vault supports multiple withdrawal methods for enhanced flexibility:

Standard Withdrawal Functions

withdraw(amount, receiver)- Withdraw a specific amount of BERAredeem(shares, receiver)- Redeem a specific number of shares

Enhanced Withdrawal Functions

queueRedeem(shares, recipient)- Queue a withdrawal based on the number of shares you want to redeemqueueWithdraw(amount, recipient)- Queue a withdrawal based on the exact amount of BERA you want to withdrawcancelQueuedWithdrawal(requestId)- Cancel an existing queued withdrawal

Completion Functions

completeWithdrawal(isNative)- Complete the most recent withdrawal requestcompleteWithdrawal(isNative, requestId)- Complete a specific withdrawal request by ID

Important Notes

- Multiple requests: You can have multiple withdrawal requests active simultaneously

- Cancellation: Withdrawal requests can be cancelled before completion

- No rewards earned during the unbonding period

- Withdrawal requests expire after 7 days if not completed

Yield Sources

PoL Incentive Redirection

Your yield comes from the 33% incentive redirection from PoL protocols:

- Protocols pay incentives to validators for directing BGT emissions

- 33% redirected during incentive distribution and sent to the Incentive Collector

- Incentives auctioned for WBERA

- WBERA distributed to Staking Vault stakers

Auto-Compounding

Your rewards automatically compound:

- No manual claiming needed

- Continuous yield growth as more incentives come in

- Your share value keeps growing over time

Best Practices

Staking Strategy

- Long-term holding: The 7-day unbonding period works best for long-term staking

- Regular deposits: Consider dollar-cost averaging your BERA deposits

- Monitor yield: Keep track of how your position grows over time

Risk Management

- Plan withdrawals: The unbonding period means you need to plan ahead

- Diversify: Don't put all your BERA in one place

- Stay informed: Keep up with governance changes that might affect parameters

Available Actions

What You Can Do

- Stake BERA directly: No need to wrap first - the system handles it automatically

- Stake WBERA: If you already have wrapped BERA tokens

- Request withdrawals: Start the unbonding process to get your BERA back

- Complete withdrawals: Claim your BERA after the unbonding period ends

Contract Information

- Staking Vault:

0x118D2cEeE9785eaf70C15Cd74CD84c9f8c3EeC9a - WBERA Token:

0x6969696969696969696969696969696969696969 - Incentive Fee Collector:

0x1984Baf659607Cc5f206c55BB3B00eb3E180190B

TIP

For technical implementation details and function signatures, see the WBERA Staker Vault contract documentation.