Proof-of-Liquidity Overview 📓

Proof-of-Liquidity (PoL) is an extension of Proof-of-Stake (PoS) that realigns economic incentives among validators, applications, and users. This is enabled through a two-token model - a token responsible for chain security ($BERA) and a token responsible for governance and rewards ($BGT).

Core Components

Security Layer ($BERA)

Berachain's Active Set of validators (validators participating in consensus) is determined by validators' $BERA stake, with a minimum of 250,000 $BERA and a maximum cap of 10,000,000 $BERA. The top 69 validators ranked by stake are in the Active Set. Within the Active Set, a validator's probability of proposing a block is proportional to their staked $BERA — more $BERA staked increases the likelihood of proposing a block.

Reward Layer ($BGT)

The size of a validator's $BGT block reward is determined by their Boost, which is a percentage calculated from the validator's $BGT boost divided by the total $BGT boosted to all validators. Boosts are obtained when $BGT holders delegate to validators.

Learn more about how emissions are calculated on the emissions page.

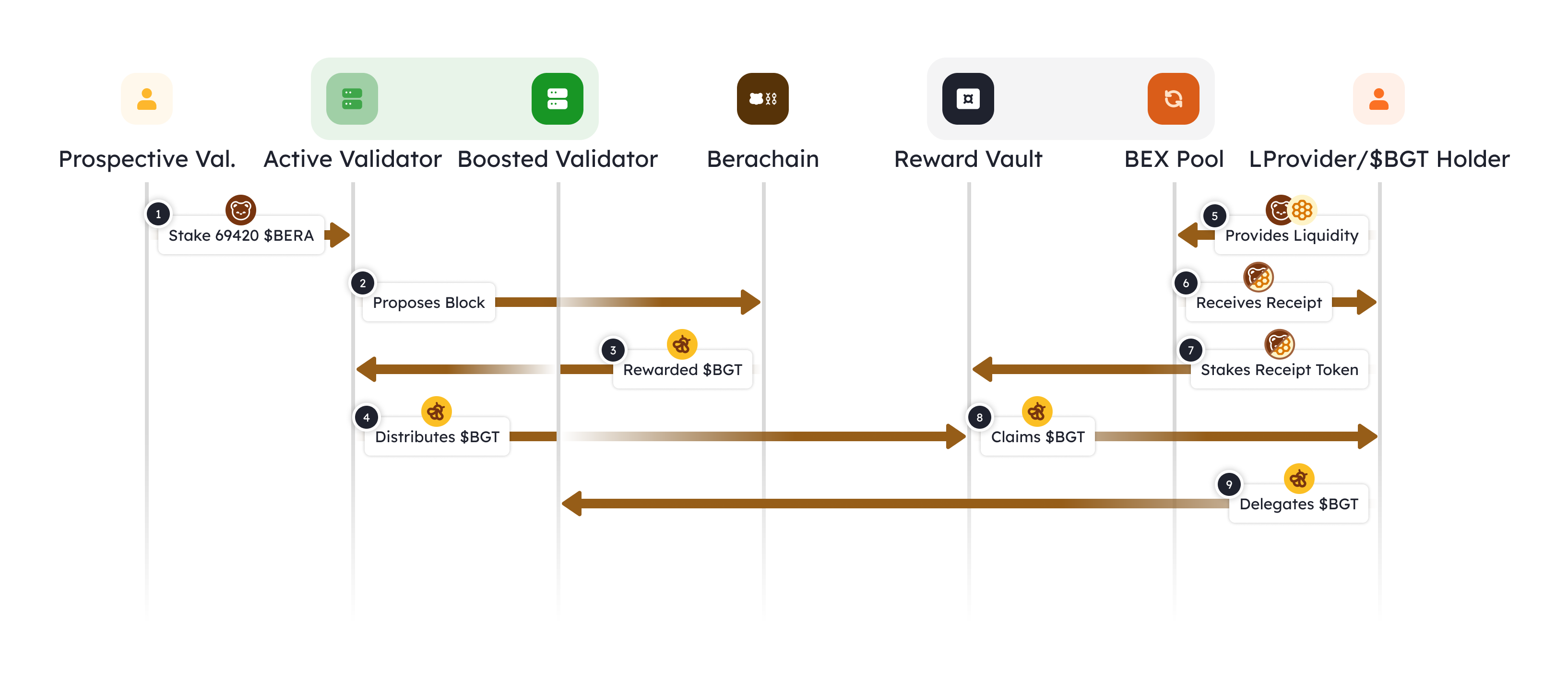

PoL Lifecycle

1. Validator Lifecycle

The journey begins when a Prospective Validator stakes their $BERA as a security bond (①). Validators are chosen to propose blocks with a probability proportional to their staked amount (②). For each block proposed, the validator receives both a base emission and a variable reward emission based on their boost percentage (③) (see emissions).

2. Reward Distribution

After collecting the base $BGT rewards for themselves, validators direct the remaining variable $BGT rewards to whitelisted Reward Vaults of their choosing (④). In exchange for directing their emissions, validators receive protocol-provided Incentives from Reward Vaults (the $BGT is earned by users supplying liquidity to the protocol).

3. Liquidity Provider Flow

The ecosystem's liquidity providers (i.e., users) play a crucial role in PoL. Users can provide liquidity to protocols like BEX (⑤) and receive receipt tokens as proof of their contribution (⑥). These receipt tokens are then staked in Reward Vaults (⑦), where users earn $BGT proportional to their share of the vault (⑧).

4. Delegation Cycle

As $BGT Holders accumulate tokens, they can delegate them to validators (⑨), directly influencing the validator's boost. This creates a virtuous cycle where higher delegation leads to increased validator boost, resulting in larger $BGT emissions when that validator proposes blocks. Validators are incentivized to share their received protocol Incentives with delegators to attract more boosts, fostering a collaborative ecosystem.

Ecosystem Alignment 🤝

By integrating Berachain's native network rewards among all ecosystem participants, PoL creates alignment between:

- Validators: Need

$BGTdelegation to maximize their block rewards and must efficiently direct emissions to reward vaults to earn Incentives and attract more boost. - Protocols: Compete for

$BGTemissions by offering attractive Incentive rates in their reward vaults - Users: Earn

$BGTby providing liquidity, then delegate to validators who maximize returns