Proof-of-Liquidity Overview 📓

Proof-of-Liquidity (PoL) is an extension of Proof-of-Stake (PoS) that realigns economic incentives among validators, applications, and users. This is enabled through a two-token model - a token responsible for chain security ($BERA) and a token responsible for governance and rewards ($BGT). Further information about our design goals for Proof of Liquidity are in the Honeypaper

Core Components

Security Layer ($BERA)

Berachain's Active Set of validators (validators participating in consensus) is determined by validators' $BERA stake, with a minimum of 250,000 $BERA and a maximum cap of 10,000,000 $BERA. The top 69 validators ranked by stake are in the Active Set. Within the Active Set, a validator's probability of proposing a block is proportional to their staked $BERA — more $BERA staked increases the likelihood of proposing a block.

Reward Layer ($BGT)

The size of a validator's $BGT block reward is determined by their Boost, which is a percentage calculated from the validator's $BGT boost divided by the total $BGT boosted to all validators. Boosts are obtained when $BGT holders delegate to validators.

Learn more about how emissions are calculated on the emissions page.

Reward Allocation Management (BeraChef)

BeraChef manages the configuration layer of PoL, controlling how validators direct their BGT rewards across different Reward Vaults. It handles validator reward allocation preferences, vault whitelisting, and commission management, ensuring that only governance-approved protocols can participate in the ecosystem.

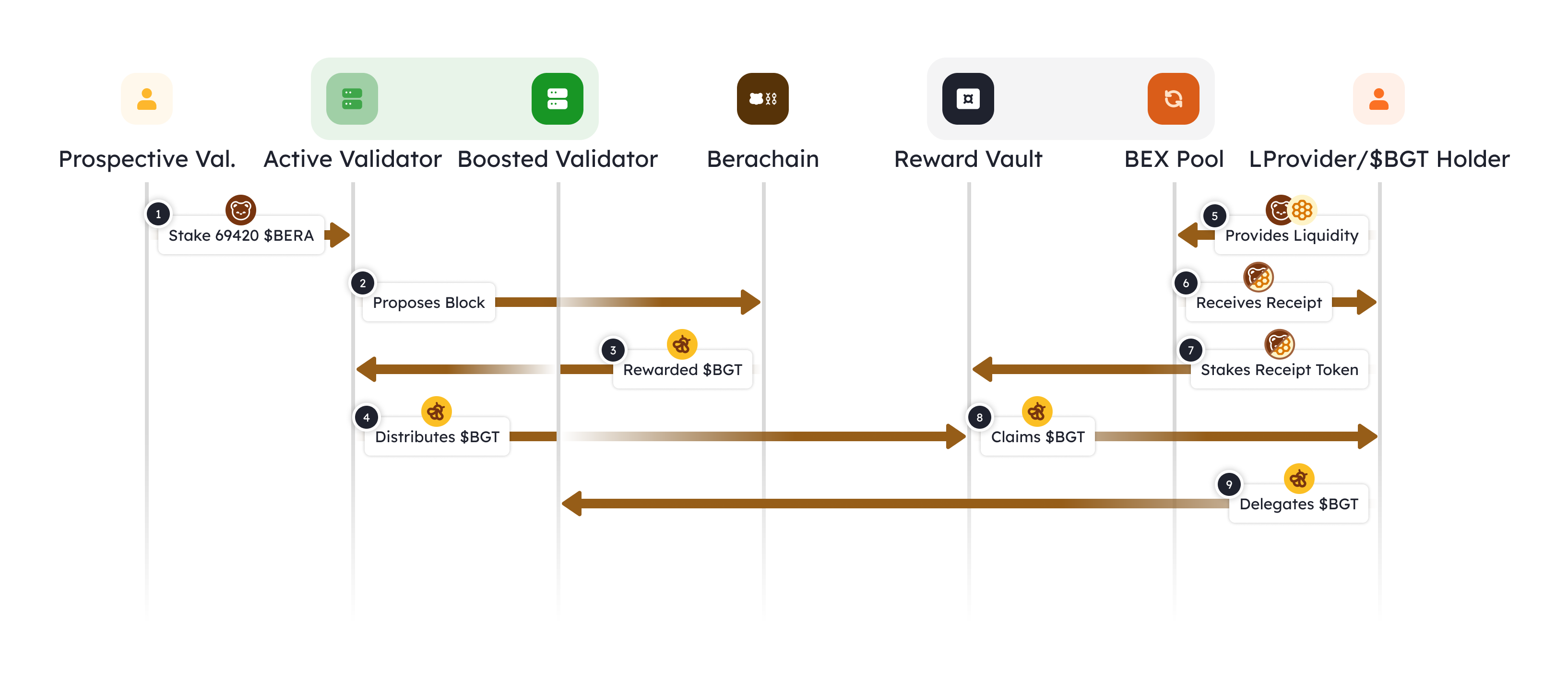

PoL Lifecycle

1. Validator Lifecycle

The journey begins when a Prospective Validator stakes their $BERA as a security bond (①). Validators are chosen to propose blocks with a probability proportional to their staked amount (②). For each block proposed, the validator receives both a base emission and a variable reward emission based on their boost percentage (③) (see emissions).

For Validators: Learn about the validator lifecycle.

2. Block Reward Distribution

After collecting the base $BGT rewards for themselves, validators direct the remaining variable $BGT rewards to whitelisted Reward Vaults of their choosing (④). In exchange for directing their emissions, validators receive protocol-provided Incentives from Reward Vaults (the $BGT is earned by users supplying liquidity to the protocol).

For Validators: Learn about managing your reward allocations and setting commission rates.

3. Liquidity Provider Flow

The ecosystem's liquidity providers (i.e., users) play a crucial role in PoL. Users can provide liquidity to protocols like BEX (⑤) and receive receipt tokens as proof of their contribution (⑥). These receipt tokens are then staked in Reward Vaults (⑦), where users earn $BGT proportional to their share of the vault (⑧).

Learn about integrating with Berachain's incentive system and Reward Vault design.

4. Delegation Cycle

As $BGT Holders accumulate tokens, they can delegate them to validators (⑨), directly influencing the validator's boost. This creates a virtuous cycle where higher delegation leads to increased validator boost, resulting in larger $BGT emissions when that validator proposes blocks. Validators are incentivized to share their received protocol Incentives with delegators to attract more boosts, fostering a collaborative ecosystem.

For BGT Holders: Learn how to boost a validator with BGT to participate in the delegation cycle.

Ecosystem Alignment 🤝

By integrating Berachain's native network rewards among all ecosystem participants, PoL creates alignment between:

- Validators: Need

$BGTdelegation to maximize their block rewards and must efficiently direct emissions to reward vaults to earn Incentives and attract more boost. - Protocols: Compete for

$BGTemissions by offering attractive Incentive rates in their reward vaults - Users: Earn

$BGTby providing liquidity, then delegate to validators who maximize returns